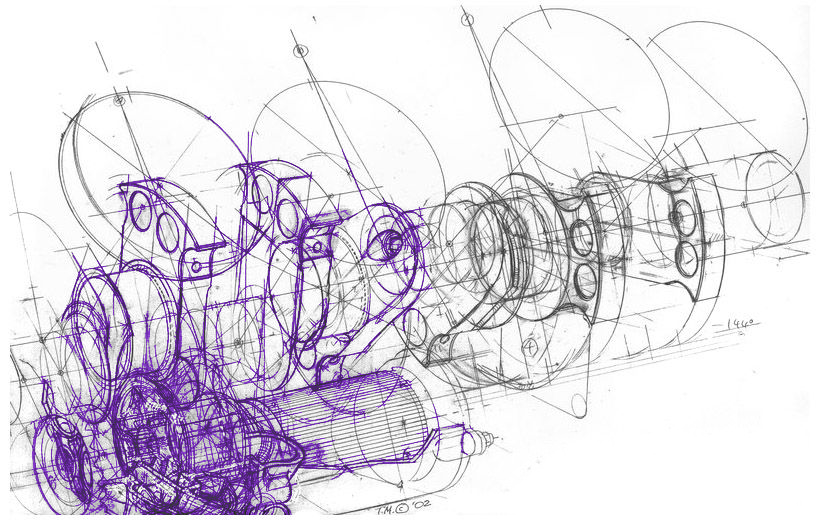

Automate trading order execution

Simple but not easy ... Managing bid/ask slippage for liquid or thinly traded stocks & recalculating order size accordingly is prone to errors

We implement an optimal limit-order price strategy for fast order execution from a risk management perspective.

Trading orders sizes are recalculated from real-time bid/ask prices, to rapidly execute on asset allocation orders,

and prevent the risk of long periods of "no fill" affecting sell-then-buy order flows, and prevent buying-on-margin.